Reputation Management Excellence

Companies, organizations, and individuals around the world partner with Reputation X for online reputation management services, Wikipedia writing and editing, reputation strategy, review management, and much more.

1.800.889.4812

How Can We Help You?

Choose a reputation management service area.

Repair Reputation

Remove search results, improve online sentiment, and regain control of your brand image.

Learn more about repair reputationImprove Online Brand

Build your brand image, rank higher in search results, and drive more business growth.

Learn more about improve online brandEdit Wikipedia

Create a new Wikipedia page, edit existing Wikipedia pages, and monitor pages for changes.

Learn more about edit wikipediaTrusted for Over 15 Years

The Reputation X team are like

surgeon-wizards for the internet.

You will be glad to have Reputation X as a strategic partner

Really smart people. That’s why Reputation X is one of our most important partners.

Services

From negative content removal to suppression, correction, and ratings and improving Wikipedia, our experts can solve nearly any online brand issue.

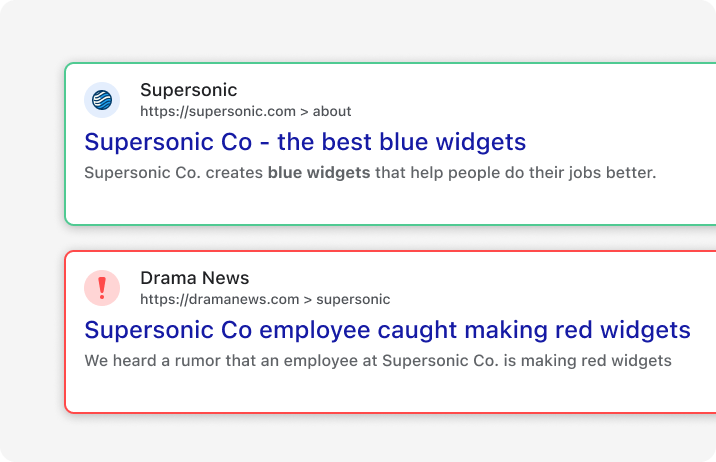

Remove Search Results

Remove search results, improve online sentiment, and regain control of your brand image.

Remove Results from Search

Suppress Search Results

Reduce the visibility of negative information online. Replace it with positive content.

Suppress Search Results

Reputation Strategy

Design a reputation improvement roadmap to both improve and protect your brand.

Reputation Strategy

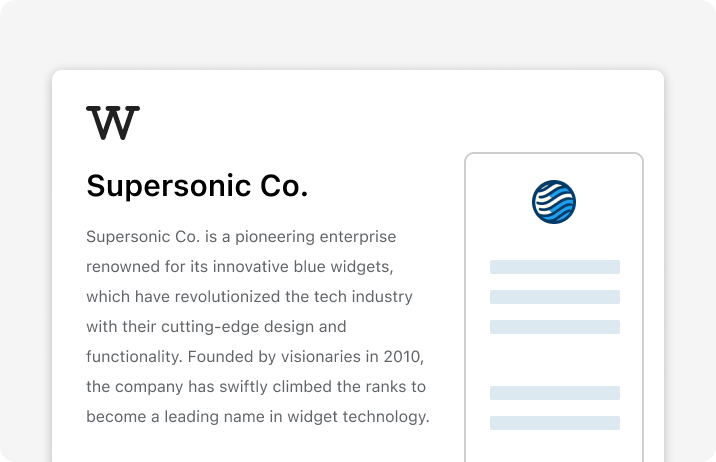

Create A Wikipedia Page

Earn a Wikipedia article for yourself or your brand. Leverage your notability.

Create Wikipedia Articles

Edit An Existing Wikipedia Page

Edit Wikipedia pages. Correct inaccuracies, balance the narrative, reduce bias.

Wikipedia Editing Services

Reputation Marketing

Online reputation marketing services to improve how a brand is seen online.

Reputation Marketing Services

Remove Content from Search

Remove or suppress unflattering online images.

Remove Results from Search

Improve Online Reviews

Improve star ratings, remove damaging reviews, increase positive reviews and monitor the online narrative.

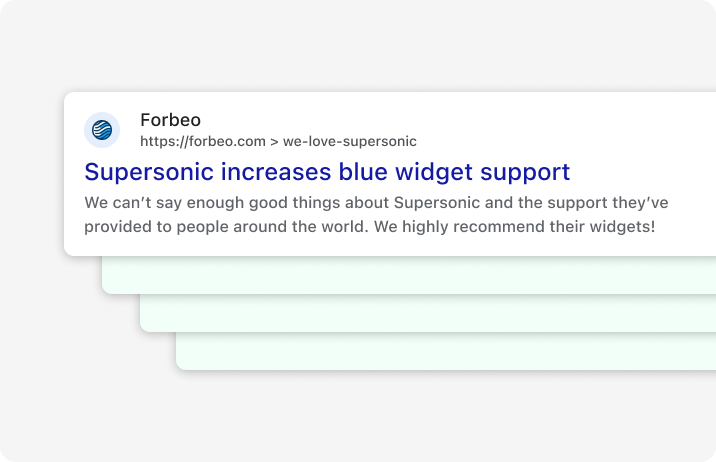

Improve Your Online Brand

Improve Knowledge Panels

Improve Knowledge Panel content by taking control and finding and changing source material.

Knowledge Panel Improvement

Case Studies, Guides and Articles

Information about reputation management and Wikipedia writing.

Overview

Overview of Online Reputation Management

Learn about what reputation management can accomplish and how it’s done from the experts.

See OverviewOnline Reputation FAQ

Answers to questions about reputation management services and Wikipedia editing.

What is reputation?

Reputation is people’s general opinion or estimation about someone or something. It measures how much respect, admiration, credibility, or trust a person or entity has earned in a particular social group or community. Reputation is often based on the perceived quality of an individual’s or group’s actions, character, and accomplishments. A person or entity with a good reputation is generally seen as reliable, trustworthy, and worthy of respect. Conversely, a person or entity with a bad reputation is often seen as untrustworthy, unreliable, or lacking in character.

What’s ReputationWhat is reputation management?

Reputation is people’s general opinion or estimation about someone or something. It measures how much respect, admiration, credibility, or trust a person or entity has earned in a particular social group or community.

Reputation is often based on the perceived quality of an individual’s or group’s actions, character, and accomplishments. A person or entity with a good reputation is generally seen as reliable, trustworthy, and worthy of respect. Conversely, a person or entity with a bad reputation is often seen as untrustworthy, unreliable, or lacking in character.

Why is reputation management important?

Managing your reputation is a key success factor. Reputation affects career opportunities, business relationships, and social status for individuals, while impacting the bottom line, customer attraction, and market valuation for businesses. A good reputation is built on trust, credibility, and integrity, and offers competitive advantages. Not only does it improve customer acquisition, it also provides resilience during a reputational crisis. Actively managing your reputation is essential in a world where everyone Google’s you long before you meet.

Why ImportantHow long does reputation repair take?

Reputation repair (excluding removals) that involves pushing negative content down and positive content up takes about two months to begin working in most cases. The average reputation repair campaign takes six to ten months for satisfactory results.

How LongWhat do reputation management services cost?

High quality online reputation management services are resource-intensive. Costs can range from about USD $4,000 per month and up. Costs vary due to degree of difficulty as well as other factors. Review and ratings management can cost as little as $250 per month.

Pricing