Monitoring the Online Presence of Competitors

Monitoring your direct competitors is a key part of any marketing strategy.In fact, most business owners assume they are already doing enough to keep an eye on their competitors by tracking their key positions in Google.While monitoring your competitors’ rankings is very important for foreseeing an upcoming traffic spike or loss, there’s seldom any practical use for that tactic.I mean, what are you going to do if you notice your competitor’s page climbing up in SERPs?I am a huge advocate of actionable roadmaps, i.e., marketing tactics that trigger or inspire some action on your part.While I don’t dispute the need to monitor your competitors’ rankings, I do think that you need to do much more in order to promptly diagnose their success or failure and take some action.

Sections

- Monitor your competitors’ landing pages

- Monitor your competitors’ backlinks

- Monitor your competitors’ unhappy customers

1. Monitor your competitors’ landing pages

You will likely monitor SERP movements for some of your competitors’ pages. You are likely to know if one of those pages drops or grows in rankings. But how are you supposed to diagnose the reason for that drop or spike?

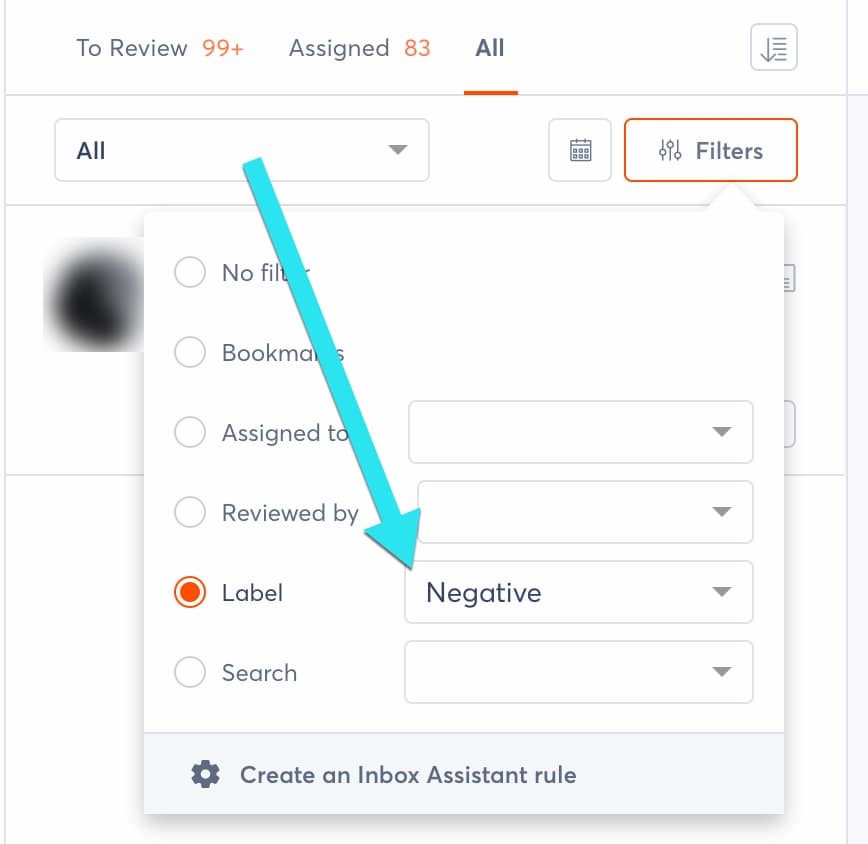

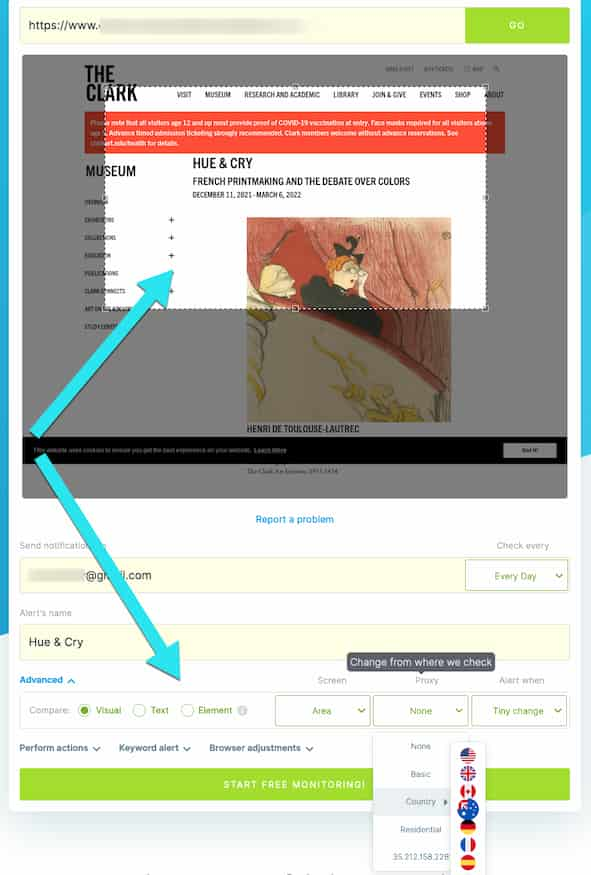

The answer is obvious: Keep an eye on their on-page SEO

Has your competitor changed the title tag of that page? Have they edited its copy? Have they added or removed a video or an image? Was there a change in the page structure?None of that will trigger an immediate change in rankings, but it may with time, so you wouldn’t know unless you spot that change when it happens.Keeping an eye on your competitors’ SEO maintenance tactics (i.e., how they update their existing pages) is a great way to predict their SERP movements.Visualping is a unique tool that monitors any visual or text changes to any web page.

2. Monitor your competitors’ backlinks

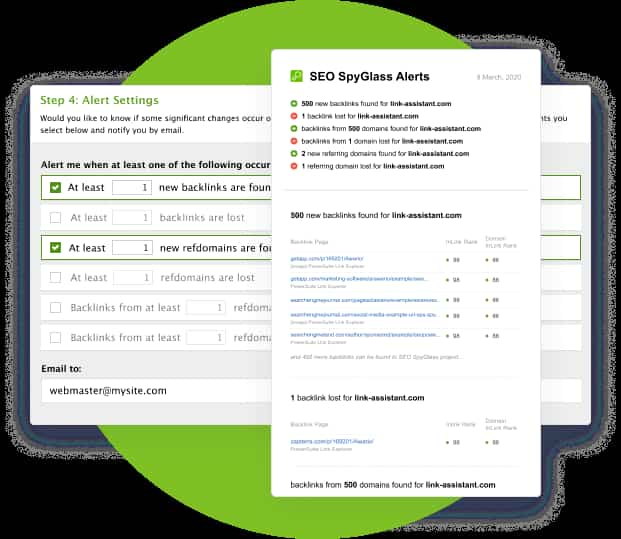

Links still remain the strongest signal determining how Google ranks web pages. And just like with on-page factors, a newly acquired high-quality backlink from a trusted resource won’t boost a page’s rankings right away but it will likely contribute to slowly improving positions.Therefore, looking back, it is difficult to tell which of those backlinks may have played their role in your competitor’s organic positions. But if you are notified of those newly acquired links as they come, you will be able to decipher which of those are influencing the situation.There’s another important reason to keep an eye on your competitors’ backlinks: You will know exactly what they are doing to build links.Link building is tough, and building natural links is very challenging, so using your competitors’ experience is a good idea.Don’t get me wrong, it is not about copying your competitors’ links. It is about using them as a learning curve:

- Which content do your competitors create to acquire links, and what works best for them?

- Who are your competitors’ promoters, and can you win these media publishers’ on your side?

- Are your competitors using any lower-quality link-building tactics, and what kind of impact do those have on their rankings?

Competitive backlink monitoring can answer many questions.Link Assistant has a cool “alerts” feature that – among other things – can be used to notify you of newly discovered links pointing to your competitors.

3. Monitor your competitors’ unhappy customers

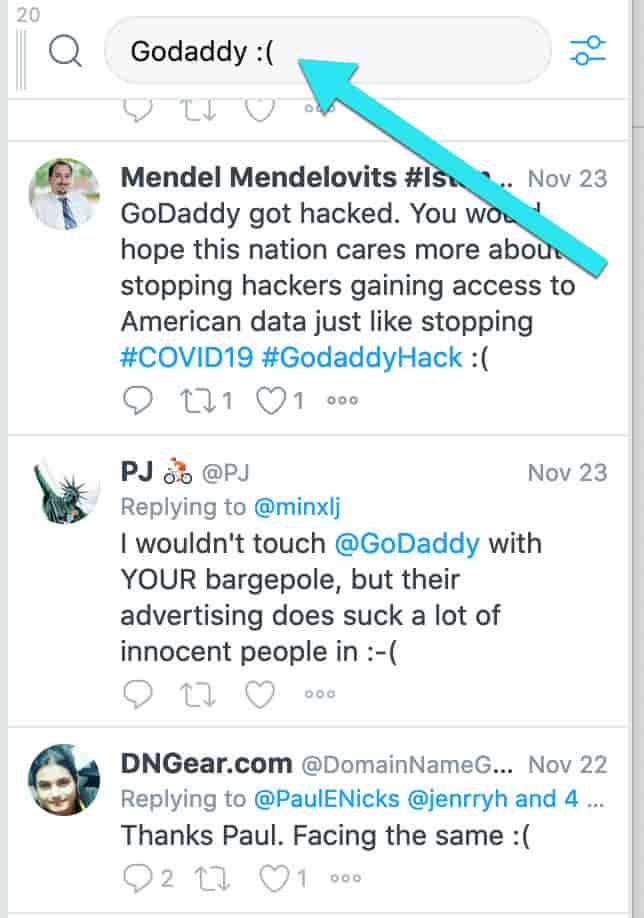

Finally, your competitors’ customers and followers will tell you a lot about what is wrong with that company.Strictly speaking, it is not exactly about SEO monitoring, but this type of monitoring will help you avoid your competitors’ mistakes, predict their looming reputation crisis, and learn to improve your product which would close a gap in your target niche.In essence, this monitoring creates an important connection between SEO and sales by allowing the two teams to collaborate on doing better than the competitors.Twitter is a great way to monitor public conversations, and the platform supports “emotional” search – in essence, tweets containing 🙂 or :(All you need is to search Twitter for:

[brand name :(]

To find anyone discussing that brand and expressing unhappiness.Tweetdeck is a good way to monitor that search via a separate column:

Final thoughts

Competition monitoring is essential to any marketing strategy and can help you make many informed marketing decisions. But choose your competitors to track wisely.Amazon, for example, is competing with just about half of the eCommerce businesses I’ve encountered. But monitoring Amazon will hardly be helpful. The platform doesn’t have to do anything to generate backlinks (publishers just link to them because they know the brand), and it is so huge that it ranks just because Google trusts them.A better choice would be a less established and newer brand that is actively engaging in marketing. Identify a fast-growing niche competitor to set up close monitoring of what it is they are doing and learn from someone hungry and creative. Good luck!

About the author

Tags: Reputation Marketing.