FINRA and SEO for Financial Services Firms in Todays Online Environment

Online marketing and SEO for the financial services industry is often heavily regulated by entities like FINRA. The rules financial firms must live by make SEO and content marketing more challenging for the industry. But there are still ways to craft effective campaigns.

Financial firms are regulated by the SEC, FINRA, and the MSRB. While all are important, for online marketers, FINRA stands out. FINRA stands for Financial Industry Regulatory Authority. It directs firms to comply with the standards of the SEC, the Municipal Securities Rulemaking Board (MSRB), and SIPC advertising rules.

FINRA marketing regulations, and specifically FINRA rule 2210 regarding communications with the public, add an additional layer of complexity other industries don’t have to deal with. Rule 2210 states that “Retail communication” includes “any written communication, including electronic, distributed or made available to more than 25 retail investors within any 30 calendar-day period.” It’s an important rule online marketers working in the financial services space must navigate.

First: The difference between owned, earned, and paid promotion

FINRA rule 2210 regulates retail communications – that means the general public. Online marketers and SEOs often use (or overuse) blog contributions for link building. Contributor-ships work like this:

- A marketer creates an article with a link to their website embedded in it.

- They then offer it to a blog as free content.

- Blogs are always looking for fresh, high-quality content – especially if they don’t need to invest in its creation, so they often take it.

- The blog publishes the free content, and then Google follows the link that was embedded in it back to the website of the company that originally created the content.

- The link strengthens the content to which it points in search results.

Simple, right? But this method doesn’t always work well for financial services firms because the content can be construed as an advertisement to the public and could run afoul of FINRA rules. This is because even though a financial firm has not “paid” for the content to be placed, it might be argued they compensated the publisher in the form of free content.

Branded vs. Non-branded content

The other issue with this type of SEO for financial firms is that the content might be worded in a way that could be construed as a self-endorsement. In other words, an asset management firm might write an article about bull or bear markets to be placed on a third-party site. Because the article was contributed by the asset management firm, it would logically follow that it was their opinion and could be considered an advertisement.

Earned content is the best kind

The best type of content that doesn’t trigger FINRA issues is earned content from unaffiliated third parties – but the attribution is often “unfocused”. It is OK because the publisher did not receive pre-written content, and the firm did not compensate the third-party publisher. There is no money trail. This happens every day naturally. It’s how most links happen on the internet, so what could be wrong with it?

But the benefits of purely earned content are unfocused because the financial firm that is the subject of the content has no control over the article, its headline, the facts, or where the links from the article point. It’s SEO – but it’s unfocused SEO. The links could point anywhere, and while any relevant and positive link is good, the best links go to money pages on the financial firms’ websites, so those pages rise in search results.

One solution for financial firms? Focused attribution

Financial services companies can leverage the best practices of third-party content publishers by releasing information strategically and in a timed manner.

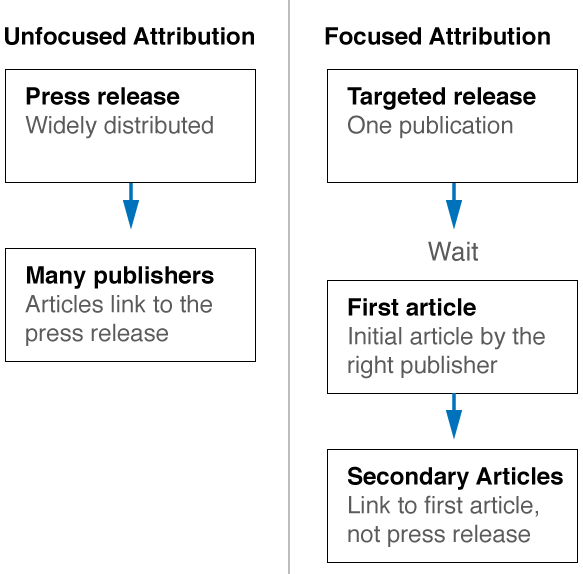

This is how it normally works: The PR departments of most financial firms create a press release and post it online as well as on the investor relations page of their site and call it a day. Various finance-related publications pick up the story and write about it, often linking to the press release. But this type of link usually doesn’t do the company much good.

But if a financial firm releases information to a specific publication first, waits for a while, and then releases the press release widely, a different set of events occur.

The first publication to generate an article will often become the original source of the content used in further reporting. Other publications will approach the story from their own angle, but they will most often cite the original publication – not the press release – as the source. When they site the original publication, they will link to it. By linking to the original publication rather than the press release, the first publication will gain far more power than the press release would have.

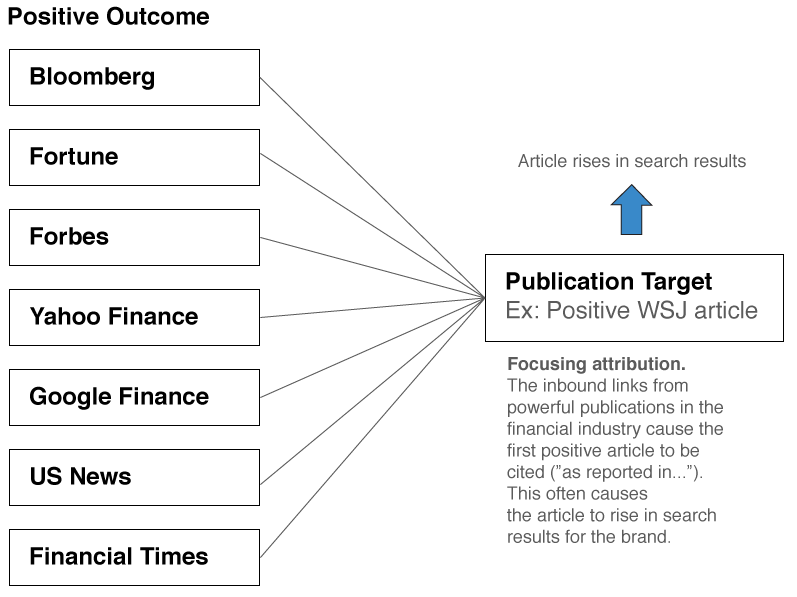

The end result

The inbound links from powerful publications in the financial industry cause the first positive article to be cited. When the content is cited, publications often create a link with text like ”as reported in…” that links to the first to publish. This often causes the article to rise in search results for the brand. It is an example of SEO for financial firms that don’t involve creating content or “advertising”.

Another way financial firms can get links

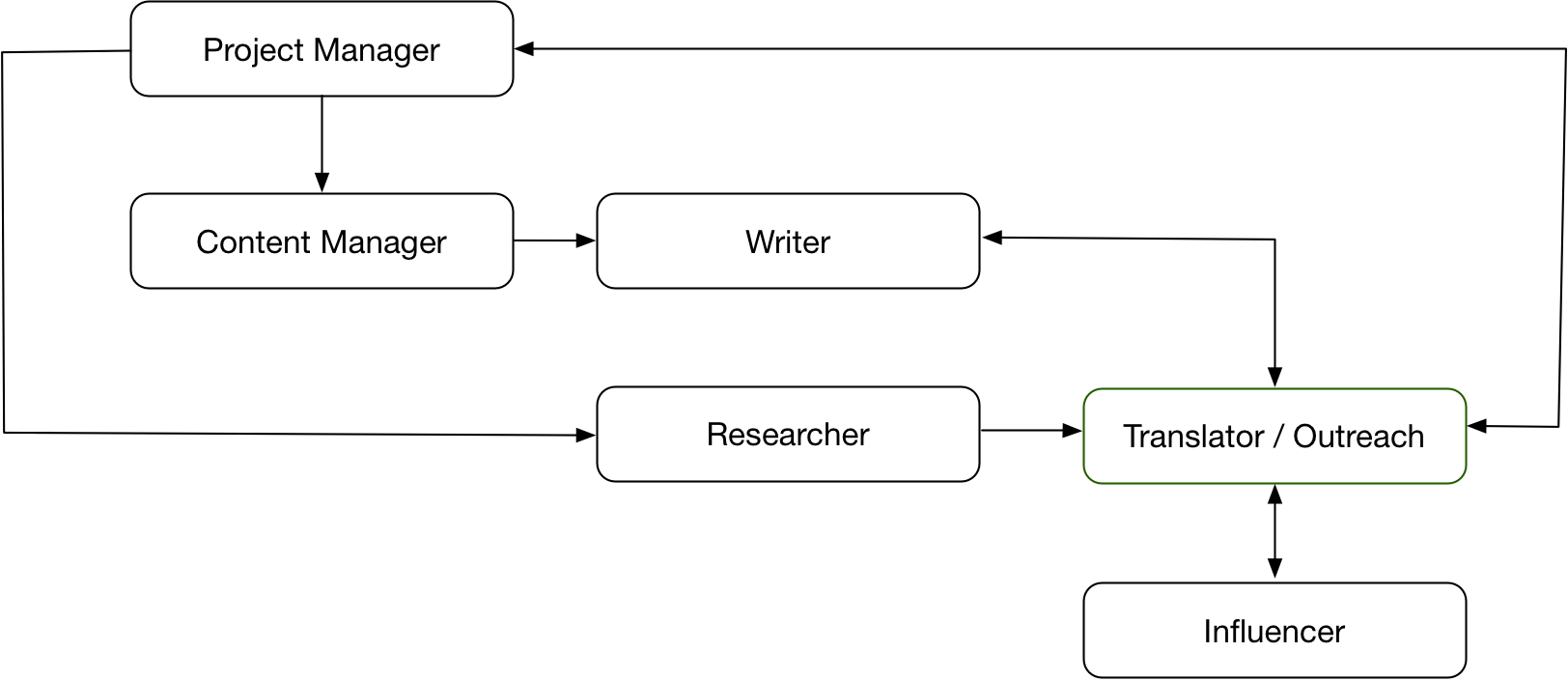

Another way financial companies can perform SEO without running afoul of FINRA or SEC regulations is to share quality content and then make influencers aware of it. Influencers will write what they want, but done properly they will link naturally to certain URLs on the financial firm’s site. Below is a diagram we use to describe how this process is executed (this diagram is for international SEO outreach).

Once a number of links are gathered, the target page can be edited into the sales funnel.

Conclusion

SEO for financial firms is more complex, but it can be done without running afoul of advertising rules if performed ethically and creatively.

FINRA and SEO for Financial Services Firms FAQs

What is a blog contributorship?

A blog contributorship is a commitment to provide free article content for a blog in your niche in exchange for a link back to your site. This method doesn’t always work well for financial services firms because the content can be construed as an advertisement per FINRA rules.

How can I promote my website without violating FINRA rules?

The best type of content that doesn’t trigger FINRA issues is earned content from unaffiliated third-parties. This type of content means that the publisher didn’t receive pre-written content, and rather wrote an article based on the writer’s research. The problem with earned content is that you can’t control the article, its headlines, or where the links from the article point.

How can financial services companies improve their PR?

Financial services companies can leverage the best practices of third-party content publishers by releasing information strategically and in a timed manner. They can also share quality content and then make influencers aware of it by tagging them or emailing them.

About the author

Kent Campbell is the chief strategist for Reputation X, an award-winning reputation management agency based in California. Kent has over 15 years of experience with SEO reputation management, Wikipedia editing, review management, and strategy. Kent has helped celebrities, leaders, executives, and marketing professionals improve the way they are seen online. Kent writes about reputation, SEO, Wikipedia, and PR-related topics, and is an expert witness for reputation-related legal matters. You can find Kent’s biography here.

–