Measuring Corporate Reputation Based on Shareholder Value

- A percentage of your company’s value can be attributed to your corporate reputation.

- In 2019, corporate reputation was responsible for one-third of the valuation of the world’s top 15 stock markets.

- Investors are more likely to buy stock in a company with a good reputation than one with a bad reputation.

- Focus on foundational business goals like satisfying customers, attracting strong employees, and generating long-term company growth.

- Over 50% of the Walt Disney Company’s value can be attributed to its reputation.

Reputation can be challenging to measure.

Though it is not something that can be quantified as an exact dollar amount, corporate reputation certainly affects your bottom line. Your revenue is affected by the way people perceive your company.

Think of your shareholders: if they are voting with their dollars for your company, you can safely assume your reputation in that sector is good. And when a customer becomes a shareholder, they become customer and partner all in one…a sort of super-customer.

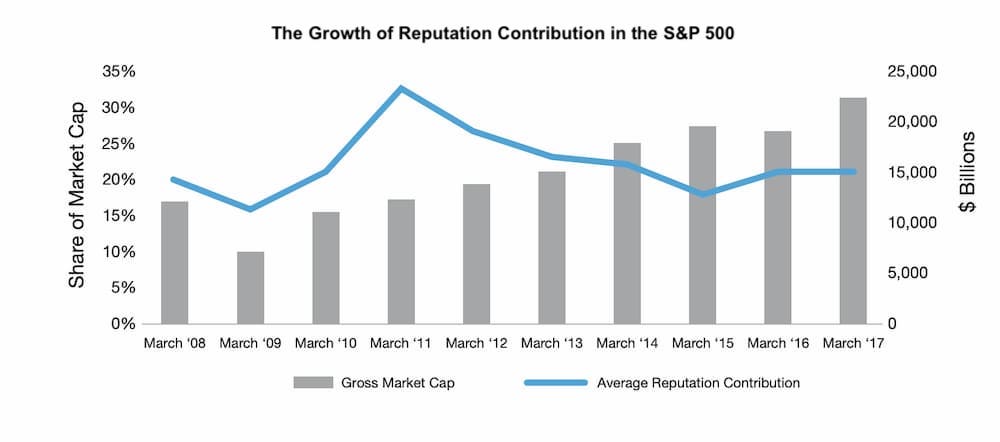

How your shareholders feel about your company affects your company’s value. In fact, a certain percentage of your company’s value—some percentage of its market capitalization—can be attributed to your corporate reputation. This percentage is called the “reputation contribution.”

According to a 2017 report from Reputation Dividend, the reputation contribution of the S&P 500 is 20% (meaning that 20% of the market capitalization of the companies in the S&P 500 can be attributed to their reputations). This added up to over $4.5 trillion in the first half of 2017.

In 2019, corporate reputation was responsible for one-third of the valuation of the world’s top 15 stock markets—a total of $16.77 trillion. That makes the shareholder a very powerful customer indeed. But how does that connect to your corporate reputation? Let’s start with some fundamentals.

Source: US 2017 Reputation Dividend Report

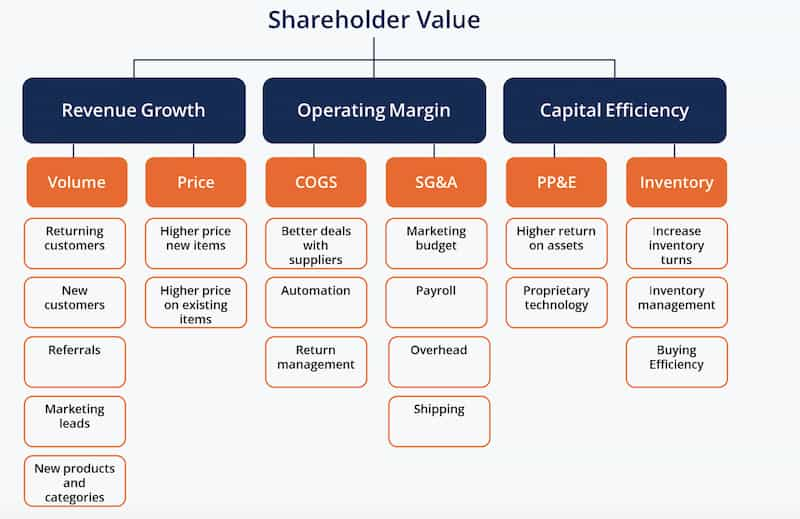

How does corporate reputation relate to shareholder value?

Your company’s corporate reputation is the way it is seen by the conglomeration of people that interact with your company. These are your stakeholders, and they include everybody:

- Customers

- Employees

- Competitors

- Entire communities

- Corporate shareholders

In emotional terms, it refers to the trust all those people have in your company based on product or service quality, past events, and probable future outcomes.

That emotional map corresponds closely with that of the individual shareholder: they invest their money in your vision over a longer period than just a single transaction. This means trusting a company through the ebbs and singing its praises during the flows. That’s a valuable customer.

How people feel about a company can determine whether or not they do business with that company, so it follows that a good reputation can add to a company’s bottom line and a bad reputation can subtract from it.

Investors decide where they spend their dollars in a similar way—they are more likely to buy stock in a company with a good reputation than a company with a bad reputation. That leads to the concept of reputation contribution: the proportion of a corporation’s market capitalizations that are a result of its reputation, good or bad.

The calculation of reputation contribution comes from a complicated analysis that quantifies corporate reputation and assigns it a dollar amount. By taking in concrete financial metrics on stock performance and mapping them against reputation reports such as Fortune’s “World’s Most Admired Companies” and Management Today’s “Britain’s Most Admired Companies,” some base correlations can be found. Specifically, the gross economic benefit shareholders derive from reputation assets.

How important is shareholder value?

There is no sensible argument for not doing good by your shareholders. In addition to providing capital for your business, shareholders are your company’s ‘cheerleaders’: presumably sticking with you through ups and downs and rooting for your overall corporate success. But should they be your primary target?

It is a risky approach to employ business practices aimed at just boosting short-term share value instead of implementing time-tested and proven fundamental business practices that drive stronger overall company value in the long run.

Former GE CEO Jack Welch eventually went from being a strong supporter of maximizing shareholder value to calling it ‘the dumbest idea in the world.” In his words: “Shareholder value is a result, not a strategy,” meaning it should take a backseat to foundational business goals like satisfying customers, attracting strong employees, and generating long-term company growth.

Harvard professors Joseph L. Bower and Lynn S. Paine spoke out against maximizing shareholder value, calling it “flawed in its assumptions, confused as a matter of law, and damaging in practice.”

Here’s how to strengthen your company’s reputation to maximize shareholder value:

- Employ fundamental business practices that focus on long-term viability and growth

- Offer quality products and services

- Focus on innovation

- Show corporate social responsibility

- Invest in good leadership

- Have responsive customer service

The positive reputation and goodwill they engender will add more value to a company than any methods implemented solely to boost stock value and appease shareholders in the short term.

There’s no denying the negative effect that losing shareholder trust has on a business. Any reputation damage will affect shareholder relations and company financial status. After the British Petroleum disaster of 2010, their shareholding diminished by 50%. People drop stocks from companies they feel have violated their trust.

This shows just how much value a good reputation contributes to your bottom line, and it also highlights how far a company’s value can plummet if its reputation is harmed.

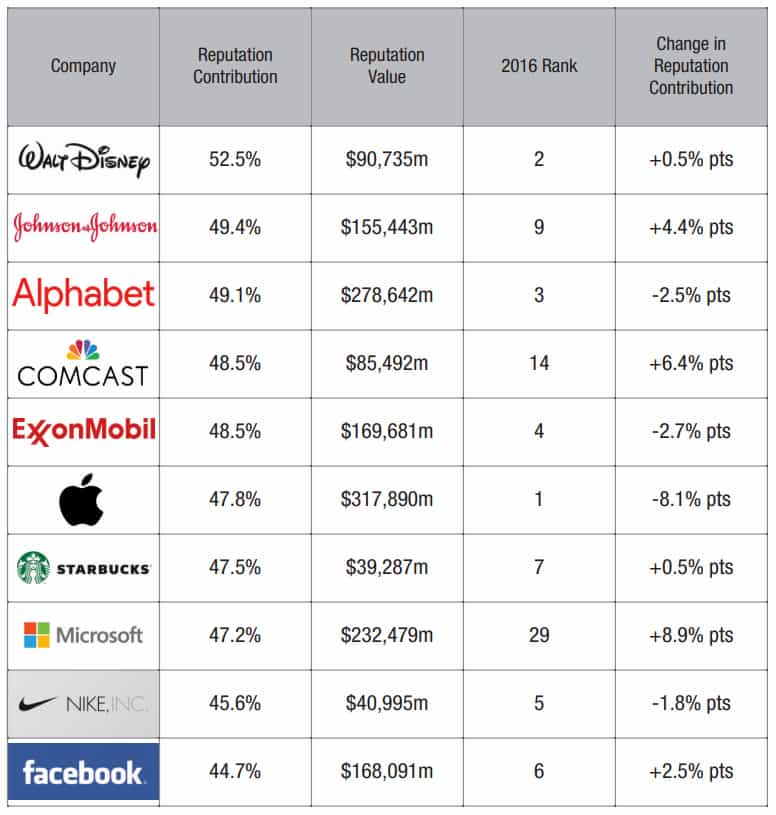

Who has a strong shareholder value-based reputation?

Reputation Dividend’s report lists the ten most powerful American corporate reputation assets (the ten highest reputation contribution percentages). Taking the top spot in the US in 2016, the Walt Disney corporation’s reputation contribution was 52.5%—over half the value of its corporation—accounting for $90.7 billion in value. In fact, every company in the top ten had a reputation contribution close to 50%. Google’s parent company, Alphabet, had the largest reputation value at over $278 billion. Clearly, a good reputation can add significant revenue to your coffers.

US top ten in reputation value

Source: US 2017 Reputation Dividend Report

Reputation Dividend reported that the impact of corporate responsibility grew more than any other factor. Given the amount of press received by examples of corporate responsibility—or irresponsibility—it would make sense that this would be a major factor to the average investor.

While building and maintaining a good corporate reputation is critical in today’s business world, having your shareholders aid in that endeavor is crucial for your corporate value. Investors are more apt to buy stock in a company with a good reputation.

Focus on solid, reputable business practices and activities, and your good corporate reputation will not simply reflect the positive perception of your company, it will enhance your bottom line.

FAQs

How is corporate reputation based on shareholder value measured?

Corporate reputation based on shareholder value is measured by the reputation contribution, which is the percentage of a corporation’s market capitalizations that can be attributed to its reputation. That figure is calculated by mapping out the quantitative financial data of a company and correlating it with the ‘softer’ reputation data.

How important is shareholder value?

Your shareholders’ opinions of your corporation have great financial sway. Reputation contributions can make up a huge portion of corporate value. But while pleasing shareholders is important, it shouldn’t take the place of satisfying customers, attracting top employees, and being a model corporate citizen.

Tags: Business Reputation Repair, Corporate Reputation, Reputation Marketing.