Can Your Reputation Be Insured?

Highlights

- Your company’s reputation is arguably its most valuable asset.

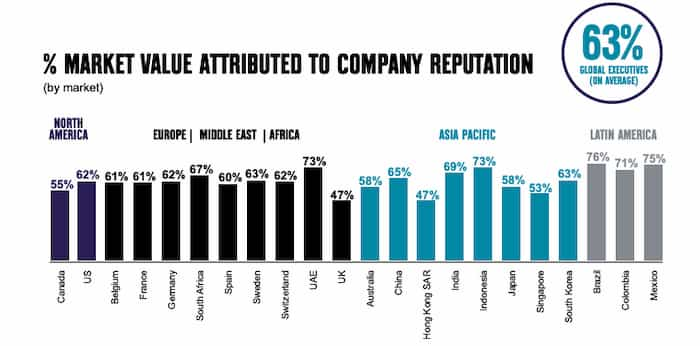

- 63% of your market value is attributed to your corporate reputation.

- The Internet and social media have made reputation insurance more vital than ever.

- Reputation insurance policies can be purchased individually or integrated into existing company insurance policies.

- Stand-alone corporate reputation insurance policies are designed to cover any financial losses related to diminished sales from a damaged reputation but come at a much higher price than an add-on policy.

Of the many things that we count on in life, our reputation ranks amongst the most important. Often directly linked to our chances for social success, reputation is the intangible standard that affects our personal and professional life in a very tangible way.

It’s important to understand how a reputation functions when it comes to businesses. When you are trying to establish a professional presence, your company’s reputation is as important as the logistics you put in place to help your business thrive. On average, global executives attribute 63% of their company’s value to its reputation.

Source: Weber Shandwick

Reputation is built around perception. It’s important to think through the ways that consumers view your company or brand. Knowing how your brand is perceived by the public can go a long way to prevent reputational harm.

When things are going well, and a business’s reputation is on point, good things often follow, such as:

- Professional opportunities

- Increased revenue

- Expanded business partnerships

- An increase in qualified applicants for open positions

- Enhanced marketing options

But what about when things go wrong? It is entirely possible that, despite all your best efforts, your business reputation might take a hit or two along the way. How can you protect your reputation? Can your corporate reputation be insured?

While it is impossible to control every aspect of public perception, there are a few things you can do to protect your business against reputation damage. Let’s take a look at a few of these options below.

What channels contribute to reputation?

Before the rise of technology and the subsequent development of social media platforms, a reputation for a business was often dependent on how the general public judged the character of that business.

Before social media, small and larger businesses alike primarily functioned on word-of-mouth and print advertising campaigns. A brand’s reputation was not uncommon to grow predominantly from a celebrity endorsement.

These days, things move more quickly, and there are more voices and opinions to factor into the reputation equation. Social media alone has begun to cast a wider net for businesses to reach potential consumers, but it also opens the floodgates of public opinion, which can both make or break a company’s reputation.

The concept of complete consumer access through digital channels means that your reputation will inevitably be put under a microscope and judged not necessarily by facts but often by opinions. And those opinions will not only be based on your company’s products and services but on the impact that your company has on its community. Business owners need to expect to be critiqued, and it is more important than ever to make plans to act accordingly in advance.

The internet is an expansive place. There are many ways that a reputation can be built up online, but those same channels can tarnish or devastate a reputation with things such as:

- Negative online reviews

- Digital coverage of a company’s shortfalls

- Social media posts from unsatisfied customers

It’s fair to say that a company’s reputation and its success are very much intertwined. The internet is an essential component of a business today, but it’s also the primary place where a brand’s reputation is established and discussed.

When your reputation is on the line, it is important to protect your company in both the physical and digital worlds. Even a great company with all the right infrastructure in place can fall under the pressure of a tarnished name.

What kinds of reputation insurance policies are available?

Insurance is often linked exclusively to clear-cut objectives. Property insurance, car insurance, and life insurance are designed to address specific risks that come with clear parameters.

Reputation damage is much more of an abstract concept than something like an accident or flood damage, but in the age of digital reputation construction and destruction, it has become an issue that insurance providers are more willing to weave into coverage policies.

Ultimately, a damaged reputation is a very real threat to a company’s welfare. Knowing your insurance options can give you peace of mind when you’re in the trenches of an online ecosystem.

A. Reputation insurance

While reputation insurance policies can be purchased individually, it is important to note that insurance like this can be expensive to buy as a stand-alone policy. While larger companies may not have any problems with the price tag, smaller businesses would likely struggle to make this investment a possibility.

The hard-to-define nature of a reputation is what brings the premium price tag to this kind of insurance policy. A stand-alone reputation insurance policy would usually be designed to cover any financial losses that relate to diminished sales from a damaged reputation. However, the root of the reputation damage is often hard to pinpoint clearly. This makes it even more difficult to underwrite a policy, which ultimately boosts the premium cost of the policy overall.

B. Reputational risk insurance

Much more common than purchasing a stand-alone reputation insurance policy is the option to integrate reputational risk insurance into existing company policies. There are sub-categories to reputational risk insurance that make it easier to tailor an add-on to a company’s specific needs. These include:

- Business owner’s liability insurance: The most wide-reaching option out of all these subcategories is business owner’s liability insurance. Typically, this is a broad coverage selection that would provide minimal protection in instances in which a business is facing a lawsuit due to false or offensive advertising or issues related to slander or libel.

- Crisis management insurance: Crisis management insurance is put in place when there’s a possibility that a company will require a public relations (PR) team to step in to handle incidents that could negatively affect its reputation. Examples of moments when this insurance would be helpful could include anything from a company-wide data breach to allegations of harassment in the workplace.

- Cyber threat insurance: Cyber threat insurance is much more specific and aims to provide coverage for online incidents that involve sensitive customer information. It also may be useful for companies that are experiencing the dissemination of false or negative reviews online, leading to a decrease in their overall sales.

Because these sub-policies are built into larger policies, they tend to be far less expensive than picking and choosing singular policies to purchase.

Next steps

While picking the right reputation-policy can be daunting to business owners, underwriting these abstract policies can be just as tricky for insurance companies. When you’re considering an investment in reputation insurance, first schedule a time to speak with an insurance provider one-on-one.

It’s important to take the necessary time to answer all of the questions that underwriters are likely to have before they begin to put a reputation insurance policy into place. Providers will want to look at everything from the number of sensitive records that a business retains to its annual revenue and any previous incidents of reputation damage that have occurred.

The questions they ask will likely be similar no matter what size your company is, but when it comes to reputation, having a tailored policy in place is going to be important. For a smaller business that might be limited on funds, investing in cyber threat insurance is likely to be a good starting point.

Larger companies tend to have more financial room to work with, but they’ll still want to make sure they have policies in place that take all potential reputational damage platforms into account. It’s important to be covered comprehensively in an age in which digital influence is a defining factor in a company’s reputation.

Reputation insurance FAQs

What is reputational risk insurance?

This is a broad form of insurance coverage that is available to companies who are looking to cover sales losses related to reputational damage. Sub-policies within this category of insurance coverage include anything from internet-specific policies to public relations (PR) assistance.

What does reputation damage mean?

Whether it stems from an incident online or in the workplace, reputational damage refers to the tarnishing of a company’s good name and standing. It’s a diminished perception of a company’s overall value that ultimately affects its profit margins.

How do you measure reputation?

Reputation is measured by analytics and feedback. Reporting on sales, SEO, and marketing achievements are all good ways to gauge success, while an emotional connection to a company’s reputation can be tracked through employee, customer, and shareholder feedback.

About the author

Kent Campbell is the chief strategist for Reputation X, an award-winning online reputation management agency. He has over 15 years of experience with SEO, Wikipedia editing, review management, and online reputation strategy. Kent has helped celebrities, leaders, executives, and marketing professionals improve the way they are seen online. Kent writes about reputation, SEO, Wikipedia, and PR-related topics.

–

Tags: Business Reputation Repair, Corporate Reputation, Online Reputation Repair, Reputation Protection.